This document deals with the important rates and the thresholds that the employers used when they operate the payroll for the year 2022-2023.

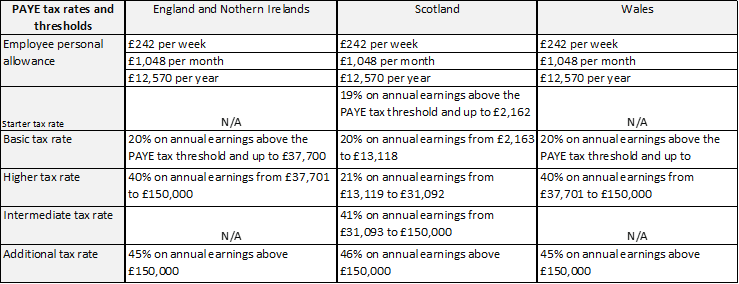

1. Tax thresholds, rates and codes

Emergency Tax codes W.E.F 6th April 2022 will be:

- 1257L W1

- 1257L M1

- 1257L X

2. PAYE tax and Class 1 National Insurance contributions

Your payroll software will be embedded with the revised rate so HMRC will be able to collect relevant data automatically.

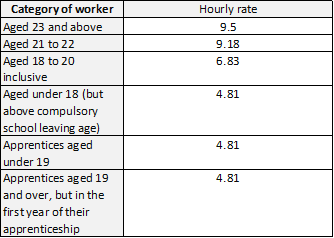

3. National Minimum Wage

These rates will apply from 1st April 2022

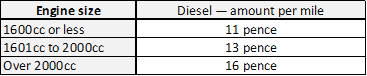

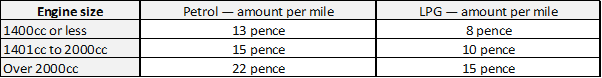

4. Company cars: advisory fuel rates

If you have provided company cars for employees, use these advisory fuel rates to work out mileage costs.

Following rates are W.E.F. 01st of April 2022

*Hybrid cars will be treated as either petrol or diesel for this purpose

For Electric cars 5p per mile will be the advisory rate

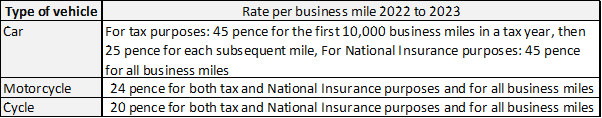

5. Employee vehicles: mileage allowance payments

These rates applicable when your employees use their own vehicles for business journeys.

Rates are as follows.